Editors note: Parts of this article are derived from CNBC.com.

Inflation is coming.

Look no further than Coke and Procter & Gamble sharing plans this week to raise prices to offset rising commodity costs. The costs of raw materials, ranging from lumber to resin, are surging, so companies are taking steps to protect profits.

The price increases follow a year of surging demand for a host of items from paper towels to jars of peanut butter. Sales of consumer packaged goods rose 9.4% to $1.53 trillion last year, according to the Consumer Brands Association. Many manufacturers pulled back on advertising and promotions as they tried to keep up with demand, gaining market share without much marketing.

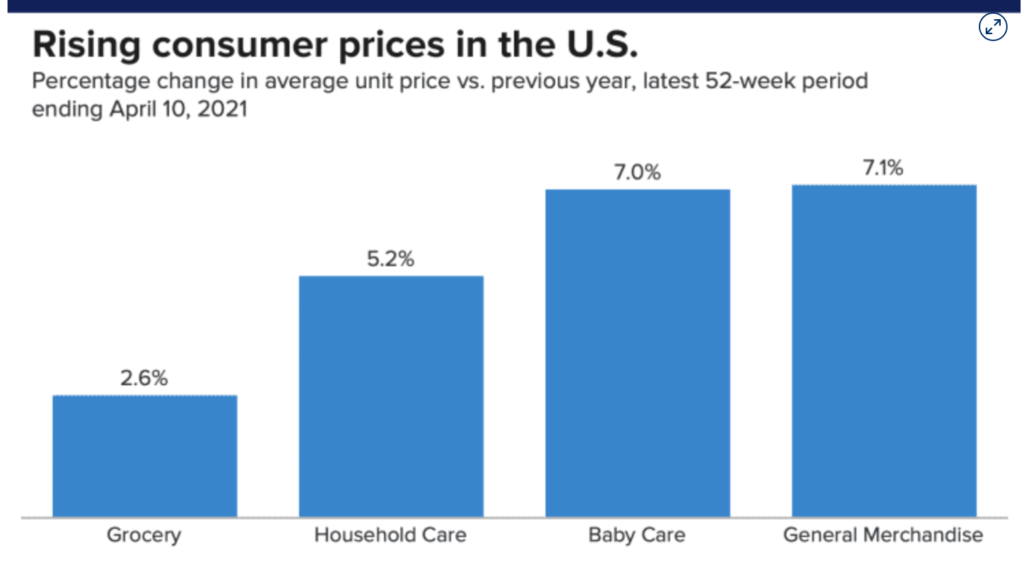

ING Chief International Economist James Knightley is forecasting consumer prices will continue to rise in the near term and could gain almost 4% by May, compared with the same time a year ago. The consumer price index, which tracks how much U.S. consumers pay for a basket of goods, rose 2.6% in March, up from the year-ago period, according to the Department of Labor.

Here’s the thing – like a Democrat passed spending bill they are hoping you won’t notice. “Consumer companies across the board have gotten very savvy about how to implement price increases without just slapping on five to 10% price increases,” Moody’s analyst Linda Montag said this week.

Some of those methods include using new packaging, selling smaller-size packs for the same price or offering promotions that bring the price down until consumers are used to the higher sticker price. Hedging positions may also give some manufacturers, like Coke and Pepsi, more flexibility to raise their prices gradually because they won’t feel the impact of higher commodity costs for several quarters.

In other words expect even more air in your bag of chips.

Since you are all a well educated set can you imagine what is going to happen if even more stimulus is pumped into the economy? That’s right – even more price hikes. Folks I accidentally paid $26 for a sandwich the other day (long story) but the day of the $10 lunch is gone. When this starts to get out of hand, and it will, the Fed will combat that by raising interest rates. That will put a nice pin pop into the red hot housing market balloon. Vicious cycle.

In the meanwhile, own the financials, protect a lot, and raise some cash – opportunity is coming and probably sooner than we might think.

Don’t be such a tease, tell the sandwich story. I, for one, want to know how one “accidentally” pays $26 for a sandwich – one can only imagine. No doubt in our host’s own words, it’ll be a kicker.

Anyone interested in a real inflation measure, one not adjusted, massaged or outright manipulated, should check out the Chapwood Index, as a true measure of real inflation. Not a pretty sight by any means, but an eye-opener.

Briefly, the methodology consists of measuring the cost a basket of 500 “real consumer economy” goods, every 6 months, in the largest 50 cities in the US. The cities’ annual rates of true inflation range from about 8% to 13%. Brutal.

Ever wonder how a hotdog at the ballpark came to cost $8? Here’s how. Using the “Rule of 72”, a 12% annual rate of inflation equates to prices DOUBLING every 6 years (72/12).

So, a $1 hotdog in 2002, became a $2 hotdog in 2008, which became a $4 hotdog in 2014, which became a$8 hotdog in 2020.

Now, if I was making 8X more than I did in 2002, all would be good, but until then, it’s down to eating Spam, and potentially a Purina product formerly only for felines.

Happy Monday everybody!

WOW!. I hope the day you eat ANYTHING not intended for human consumption (SPAM is a fence rider) never comes.

Inflation phacts provided by Phil.

Hump Day Economics alright, for those continually getting humped.

Sorry, couldn’t resist. Over & out.

This is an incredibly troubling development. The days are coming when a wheelbarrow of cash will be required to buy a loaf of bread. After WWI, Germany experienced such inflation. They printed money to repay reparation’s for starting WWI. By 1922, a loaf of bread cost over $400 Million Marks. By the end of 1923, the same loaf of bread cost $200 BILLION Marks, almost 500% increase.